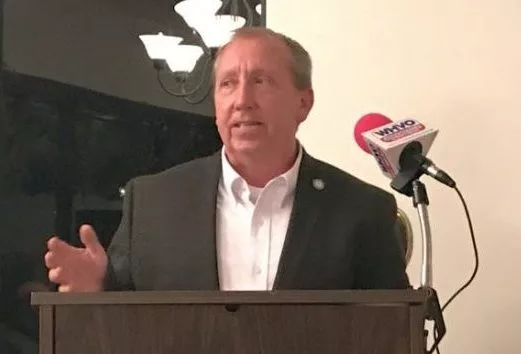

Ninth District State Representative Myron Dossett filed legislation Tuesday aimed at bringing some relief to the drastic increase in motor vehicle taxes this year.

Dossett, who represents Christian and Hopkins Counties in the Kentucky House, says House Bill 353 will address complaints from Kentuckians about an average 40 percent increase in taxes on motor vehicles and other property.

click to download audioAccording to the Office of Property Valuation, the 2022 motor vehicle valuation has increased an unprecedented 40 percent compared to 2021. Section 172 of the Kentucky Constitution requires that motor vehicles be taxed according to their fair cash value. The statutory standard used to determine this value is the average trade-in rate. However, the Department of Revenue is using the clean trade-in rate rather than the average trade-in rate to artificially increase the value of vehicles.

Dossett says this is creating a hardship for taxpayers.

click to download audioThe measure applies to state and local ad valorem taxes, including those collected by counties, cities, schools, and other taxing districts.