Kentucky Auditor Mike Harmon released the 2019 financial audit statement of Christian County Sheriff Tyler DeArmond Monday, which included two comments.

Harmon said the sheriff’s financial statements did not follow the accounting principles generally accepted in the United States; however, the statements are fairly presented in conformity with the regulatory basis of accounting, which is an acceptable reporting methodology.

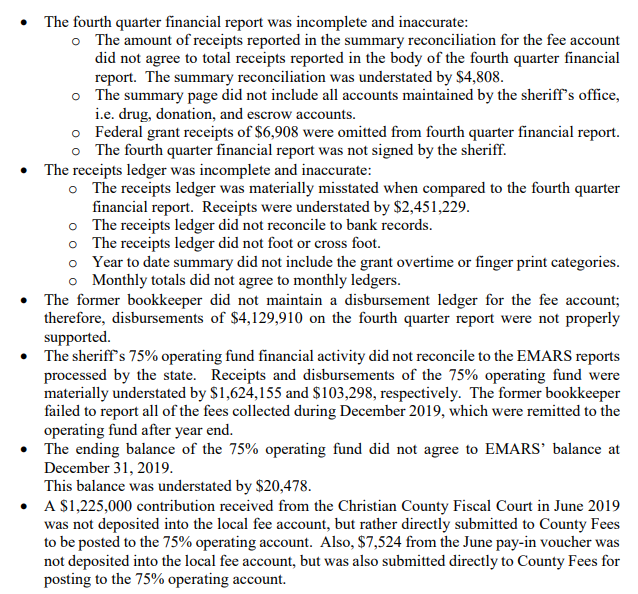

One of the comments said the Christian County Sheriff’s Office failed to implement adequate internal controls to ensure complete and accurate accounting records were maintained. According to the audit, there were no functioning internal controls in place over the work performed by the former bookkeeper. In addition, the audit said Sheriff DeArmond failed to provide adequate oversight, allowing the former bookkeeper complete control over the accounting and reporting functions. The audit added the former bookkeeper lacked sufficient understanding of all accounting concepts and responsibilities.

Additionally, the audit also said the Christian County Sheriff’s Office failed to properly account for tax commissions. The sheriff failed to remit $147,151 of tax commissions earned in October 2019 from the tax account. The finance officer said it appeared the commissions earned the last week of October were not properly distributed to the fee account.

Sheriff DeArmond said that with 2019 being the first year of his term, it proved to be challenging and educational. He added the previous administration’s bookkeeper retired with the former Sheriff, so it left his administration with many questions. Even though the department had access to people to ask questions, they were often faced with not knowing what to ask.

Halfway through 2019, Sheriff DeArmond said he discovered his bookkeeper was overwhelmed and underqualified to handle the position. He added he was able to hire the bookkeeper he has in place now, who has proven to be both capable and qualified to guide his office back to the correct path.

The Christian County Sheriff’s Department has implemented a three-step internal process to ensure accurate accounting records are maintained, they properly account for tax commissions, ensure they properly remit fees to Christian County 75/25% Accounts, and ensure they have internal control over disbursements.

Sheriff DeArmond added they would continue to work closely with their Auditors and County Treasurer to ensure all areas of his office are held and kept to the highest standards.

You can view the complete audit by clicking here.