A local distillery is being hit with a $14,000 fee for producing hand sanitizer during the pandemic — at the government’s request.

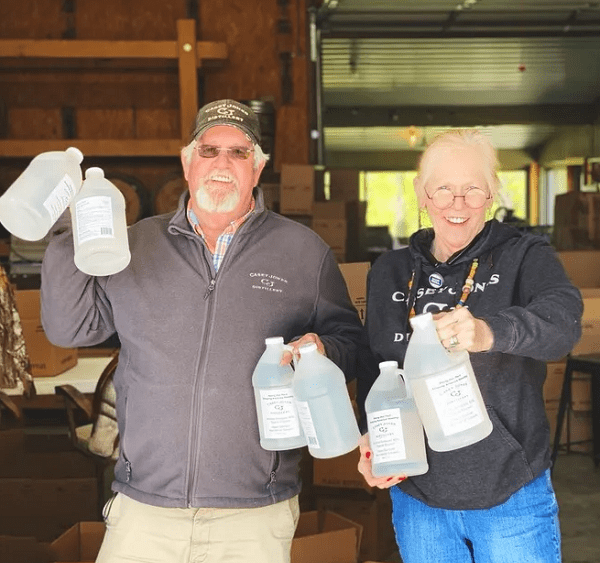

Casey Jones Distillery, along with many other distilleries, came to the rescue of hospitals, police departments, schools, homes, and restaurants during the height of the pandemic panic, rolling out half-gallon jugs of hand sanitizer. Three weeks after Kentucky’s first COVID case, March 27, their first bottle was off the line, at the federal government’s request.

Co-Founder Peg Hays tells the News Edge they did not learn of the fee until Dec. 30.

For a time, Casey Jones was cranking out thousands of gallons of hand sanitizer a week, later scaling back to a few hundred gallons a month.

Casey Jones kept their licenses and the U.S. Food and Drug Administration registrations up to date and followed all the rules. Not once was a fee assessment even mentioned. In December, they were notified that the Alcohol and Tobacco Tax and Trade Bureau extended its waiver of the tax on alcohol to June 30, 2021. Hays said everything appeared to be in order to continue producing hand sanitizer through that date.

When the pandemic began to set in, Casey Jones was one of the only places you could find the liquid gold — even hospitals were running out.

Big distilleries like Jim Beam or Jack Daniels could more easily eat the cost of the fee. But for a craft distillery like Casey Jones, a $14,060 fee knocks you off your feet.

Casey Jones produces 7,500 gallons of moonshine and 5,000 gallons of bourbon every year while employing only eight people. In a year that has been hard on nearly everyone, a fee of this magnitude could be detrimental. Especially if it happens twice. Hays cannot sell a bottle after Thursday without incurring another fee assessment.

The problem is that a provision in the CARES Act reclassified distilleries that make hand sanitizers as drug manufacturers, allowing the FDA to treat them as such with fee assessments.

Hays provided the News Edge with an FDA document outlining the fee rates for the over-the-counter monograph drug user fee program for fiscal year 2021.

The document states that on March 27, a new section was added to the Federal Food, Drug, and Cosmetic Act by the CARES Act, authorizing the FDA to assess and collect fees from manufacturers of OTC monograph drugs, which is a nonprescription drug without an approved new drug application.

The document states that the FDA will assess and collect facility fees to be assessed to each qualifying person that owns a facility identified under certain qualifications which are due 45 days after the document was published. The document was published Tuesday, while Hays and others were notified Wednesday.

The FDA released a statement Thursday afternoon stating they understand concerns over the fee, but the statute in the CARES Act does not provide any waiver provisions for any specific category of manufacturers. However, it stated the FDA is ready to work with Congress to address it.

Hays said she is trying to de-register with the FDA by the end of 2020 as a producer of an OTC drug, however, it is not a simple process.

As for what happens next, could be up to Capitol Hill. She said there should be news soon.

For the full interview with Peg Hays, see below.